The Income Tax Department sends the notices for various reasons like not filing the income tax returns, any defect while filing the returns, or other instances where the tax department is requiring any additional documents or information.

Nothing is frightening or alarming about the notice that is received. But the taxpayer has to first understand the notice, the nature of the notice, and the requestor’s order in the notice, and take steps to comply.

Tracequality offers a comprehensive suite of services for families and businesses to help them in maintaining compliance. In case an income tax notice is received, get in touch with the Tax Expert at Tracequality to understand the income tax notice and determine a course of action.

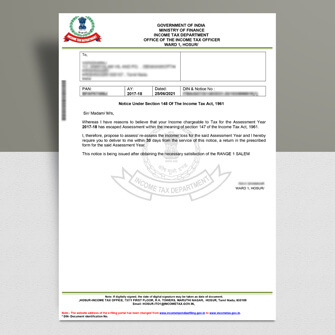

Let us understand the various types of notices or intimations issued by the Income Tax Department.

Service of Income Tax Notice

The Income Tax Act, of 1961 has laid down the law for the service of a notice, summons, order, or any other communication by delivering or transmitting a copy to the person in any method that is sanctioned under the Act. Here are the various ways in which the Income Tax Notice is served.

Recipient of the Notice: Income Tax Notices are directly addressed to the individual but if they are meant for a minor they are addressed to the guardian Incorrect description of the is usually rectifiable but in case of scenarios where

the status of the Tracequality is entangled with the identity of the name Tracequality mentioned on the face of the return may become material.

Service by Post: Service of the income tax notice can be processed through a registered post. Section 27 of the General Clauses Act 1897, specifies that the service is to be initiated by properly addressing, pre-paying, and posting by a registered post a letter that contains the document. This delivery can be made to the address, an employee, an agent, or any other authorized person.

Service by Affixture: In case a defendant refuses to sign the acknowledgement or where the officer is not able to find the defendant, then the office has to affix a copy of the summons or notice or requisition order on the outer door or any other noticeable part of the residence where the defendant is residing or pursuing the business activities.

HUFs and the Partnership Firm: If the officer discovers the total partition of any HUF it may be recorded by the assessing officer and the notices can be served on the person who was the manager of the HUF. If the concerned person is deceased then the notice will be served to all adults who were firm or other Association of Persons, notices concerning the income of the firm or the association may be served on any personnel who were former partners or members of the association that is assessed to taxation.

Closed Business: In case of closed business, the assessing officer has to serve as a notice on the person whose income is subject to assessment. In the case of the firm or an association of persons, a notice will be served to any of the members who have been a part of the firm during discontinuation. Concerning a company, the notice will be served on the principal officer or the Director.

©2022. Trace Quality . All Rights Reserved.