Form 16 is a certificate that employers issue to their employees. It is a validation that the TDS has been deducted and deposited with the government authorities on behalf of the employee of the organization.

Form 16 gives a detailed summary of the salary paid to the employees and the deducted TDS. TDS Form 16 contains all the information that an individual needs to prepare and file an income tax return.

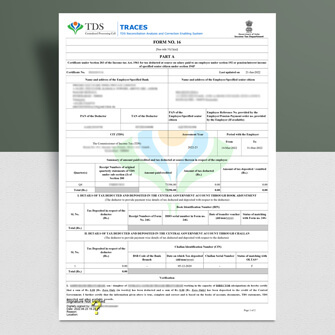

The employers are required to issue a Salary TDS certificate every year on or before the 15th of June of the coming year immediately after the financial year in which the tax is deducted. There are two components of Form 16 Part A and Part B. If an individual loses Form 16 he can request a duplicate Form from the employer.

Tracequality can help you manage TDS compliance online. Our TDS experts will help you file all the TDS returns, pay any overdue TDS deposits and also the issuance of Form 16 to the employees.

It provides the details of the TDS that is deducted and deposited. This form can be generated by employers through the TRACES portal.

The employer must verify the contents before issuing the certificate. Here are a few components of Part A of the salary TDS certificate.

It is an annexure to Part A, Part B is prepared by the employer for its employees and it contains details of the breakup of the salary deductions approved under Chapter VI-A. In case of a job change in one financial year, Form 16 should be obtained by both employers. Some of the components of Part B are:

In the TDS return filed by employers on May 31st, various details about the employee must be furnished by the employer along with details of TDS deducted and deposited. Annexure-II of the TDS return has various data-points and must be prepared carefully by the HR and Accountant of the business.

After the TDS returns are filed by the employer, the Government would issue TDS certificates to the employer – which in turn is provided to the employees.

Form 16A provides details about TDS from salary. Form 16B provides details of TDS Other than salary, Form 16C for TDS under Section 194-IB, Form 16A for TDS from other than salary, and Form 27D for TCS

The due date for issuance of Form 16 is on or before June 15th of the financial year immediately following the financial year in which the tax is deducted. In the case of Form 16A, the same should be issued every quarter.

©2022. Trace Quality . All Rights Reserved.