ITR 7 Form filing is done by the companies who service the income from the properties that are of charitable or religious purposes. Properties that are held under the trusts or legal obligation in parts or even wholly are included in the category.

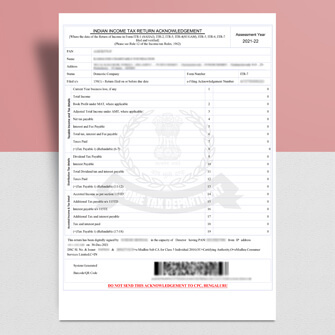

ITR taxpayers can fill the ITR 7 Forms by providing the returns through a bard coded form, physical paperback forms, or the digital signature mode, or the submission of return verification through ITR Form V.

ITR 7 Form is a file when the person and the companies fall under section 139(4A) or Section 139 (4B) or Section 139 (4C) or Section 139(4D).

ITR 7 u/s 139 (4A)

Individuals having income from the property that is used solely or partially for charitable or religious purposes and such property is to be held under a legal obligation or trust.

ITR 7 u/s 139 (4B)

This section applies specifically to the political parties. Under Section 13 A the political parties are exempted from filing the income tax return provided that the parties are filing the annual returns through Form ITR 7.

ITR 7 u/s 139 (4C)

Under this the ITR 7 is to be filed by the following entities:

ITR 7 u/s 139 (4D)

Schools, colleges, and institutions are not covered under any section of the Income Tax Act and are required to file the ITR 7 under this regulation.

ITR 7 u/s 139 (4E)

Filing the returns of the income done by a business trust.

ITR 7 u/s 139 (4F)

Is to be filed by any investment fund that is referred to in section 115 UB. There is no necessity to furnish the returns of income or loss under any provision of this section

©2022. Trace Quality . All Rights Reserved.